Articles — November 20, 2025

South America’s Outbound Travel Market: Trends and Expectations for 2026

South America is entering a new phase of outbound travel growth, shaped by economic recovery, shifting consumer priorities, and expanding international connectivity. As we move toward 2026, the region’s travelers are expected to become more adventurous, digitally driven, and quality-conscious. Countries such as Brazil, Argentina, Chile, Colombia, and Peru will play an especially prominent role in powering outbound travel demand.

1. Economic Stabilization Will Support Travel Recovery

After years of uneven performance, several major South American economies are projected to regain stability by 2026. According to ECLAC, Latin America’s GDP growth is forecast at 2.3% in 2026, with South America slightly higher.

The World Bank similarly projects continued moderate growth in the region. This macroeconomic stability is likely to boost consumer confidence and support discretionary spending on international travel.

2. Continued Shift Toward Regional and Short-Haul Destinations

While long-haul travel will continue to rebound, intra-regional travel is expected to remain a dominant trend in 2026. Travel-industry forecasts and trend reports emphasize expanding air connectivity within Latin America — especially between major cities in Brazil, Argentina, and the Andean countries.

Shorter routes tend to be more affordable, reducing cost barriers for mid-income travelers.

3. Growing Demand for Experience-Driven Travel

South American travelers are increasingly seeking “authentic” and immersive experiences. There is growing interest in:

- Culinary tourism

- Wine and gastronomy

- Nature and outdoor adventure

- Cultural heritage / local communities

- Sustainable and wellness travel

Analysts highlight that the future of outbound travel will lean toward quality, memorable experiences rather than purely mass-market tourism.

4. Digital Adoption Will Continue to Transform Travel Planning

Digitalization is deeply embedded in the region’s travel behaviors. According to Amadeus Travel Insights, GDS data show strong year-on-year growth in search and bookings for South American travelers, especially younger, mobile-first segments.

In addition, online payment platforms, travel influencers, and AI-powered personalization are expected to gain even more influence by 2026.

5. Air Connectivity to Expand — Strengthening Long-Haul and Regional Routes

Air connectivity is a major lever for growth. According to travel-industry trend reports:

Airlines are adding or reinstating long-haul routes from Brazil, Argentina, and Colombia to Europe, North America, and major regional hubs. Low-cost carriers (LCCs) are increasingly active on regional South American routes.

These developments will reduce friction for outbound travelers and make farther destinations more accessible.

6. Premium and Business Travel Will Gain Traction

Outbound demand is not just growing in volume — the premium tier is expanding. Corporate travel spending in Latin America is forecast to reach US$ 63.9 billion in 2025, according to the Global Business Travel Association (GBTA).

More South Americans will opt for higher-class flight cabins, luxury or boutique hotels, and curated travel experiences, especially among the growing affluent class.

7. Sustainability Will Influence Travel Choices — But Price Sensitivity Remains

Sustainability is increasingly a travel consideration in South America, particularly for more affluent or experience-oriented travelers. That said, price sensitivity remains a central constraint, especially among middle-class travelers.

Travel-industry reports note growing demand for eco-lodges, certified tours, and local-ownership-based tourism experiences.

8. Outlook for the Nordic & Baltic Markets: Potential for South American Travelers

Positive Signals for Nordic & Baltic Destinations

According to the European Travel Commission (ETC), Northern Europe is showing solid tourism demand. In its Q2 2025 report, the ETC projects that inbound tourism to Northern Europe will remain strong, with positive growth expected through 2026. Specifically, in 2025 ETC data highlight strong performance in Norway, Finland, Latvia, and Estonia, all showing year-on-year growth in arrivals or overnight stays.

Travel-industry commentary suggests European tourism spending could rise significantly in 2025, supporting increased capacity and broader destination appeal.

Why the Nordics & Baltics Could Appeal to South Americans

Climate Appeal (“Coolcations”)

As global warming intensifies, cooler destinations like Scandinavia are becoming more attractive. While much of this trend has been noted among European and North American travelers, it’s reasonable to expect similar appeal for South Americans interested in escaping the heat or seeking nature-based travel.

Nature and Authenticity

The Nordics offer spectacular nature experiences (fjords, forests, northern lights) and a strong brand of sustainability — aligning well with the “experience-driven” preferences of South American outbound travelers.

Growing Capacity and Visibility

With the ETC reporting growth in overnight stays and steady inbound demand, Nordic and Baltic countries may increase their marketing efforts globally, potentially including Latin America.

Most Promising Countries

When looking at South American source markets for Nordic and Baltic countries, several factors matter: travel volume, air connectivity, economic capacity, propensity to spend, and cultural interest in Europe. Based on these criteria, the most promising South American countries are:

1. Brazil – The Largest Outbound Market

Why Promising:

Population & Economy: Brazil is by far the largest country in South America (~215 million people) with a growing upper-middle class and significant affluent population.

Outbound Travel Volume: Accounts for roughly 60–70% of all South American outbound travel to Europe.

Air Connectivity: Direct flights to multiple Nordic hubs (e.g., Oslo, Stockholm, Copenhagen) are limited but available via connections in Frankfurt, Paris, or Amsterdam. Airline partnerships and open skies policies could expand these routes.

Traveler Profile: Brazilian travelers are increasingly seeking “experience-driven” destinations, including nature, adventure, and culture — all strong appeals in the Nordics (fjords, Northern Lights, hiking, design).

Potential Destinations: Norway, Sweden, Denmark, Finland, Iceland.

2. Argentina – Affluent and Experience-Oriented

Why Promising:

High Purchasing Power Among Upper Classes: Argentine travelers often prioritize Europe for vacation and long-haul trips.

Strong Cultural Affinity: European heritage and interest in European culture make the Nordics/Baltics appealing for unique experiences.

Air Connectivity: Major European flights depart from Buenos Aires (EZE) to hubs in Germany, France, and the Netherlands, which can connect efficiently to Nordic/Baltic countries.

Potential Destinations: Sweden, Denmark, Norway, Finland, Estonia, Latvia. Argentina has a notable interest in destinations that offer nature and design experiences.

3. Chile – Stable, High-Income Market

Why Promising:

Economic Stability: Chile has one of the most stable economies in South America, with a high-income population.

High Travel Propensity: Chileans are known to travel abroad frequently and have strong interest in nature, culture, and adventure — fitting for Nordic experiences (fjords, winter sports, wellness).

Direct & Indirect Connectivity: Santiago (SCL) is well-connected to Europe, making multi-stop itineraries to the Nordics/Baltics feasible.

Potential Destinations: Norway, Sweden, Finland, Iceland, Latvia (Baltic culture, medieval cities).

4. Colombia – Fast-Growing Outbound Market

Why Promising:

Rising Middle Class & Wealthier Segments: Colombia’s upper-middle class is expanding and increasingly willing to spend on Europe.

Young, Adventure-Oriented Travelers: Interest in nature, skiing, hiking, and city culture aligns with Nordic experiences.

Air Connectivity: Direct flights to European hubs via Bogotá (BOG) enable connections to the Nordics/Baltics.

Potential Destinations: Sweden, Denmark, Norway, Estonia, Latvia.

5. Peru – Niche, High-Spending Segments

Why Promising:

Cultural Travelers: Peruvians traveling abroad are often experience-driven, interested in history, architecture, and nature.

Smaller Market but High Potential: The market is smaller than Brazil/Argentina but represents a premium audience for Nordic and Baltic tourism.

Potential Destinations: Finland, Iceland, Norway, Estonia, Lithuania.

Strategic Implications

By 2026, South America’s outbound travel market is poised for steady and diversified growth, driven by economic stabilization, digital adoption, and evolving traveler expectations. While intra-regional travel will remain important, long-haul routes will grow, and premium experience-oriented demand will expand.

For Nordic and Baltic tourism destinations, there is promising—but not yet mainstream—potential to attract more travelers from South America. To tap into this, these destinations could:

Develop targeted marketing campaigns in South America (Brazil, Argentina, Chile) emphasizing nature, sustainability, and “cool” climate experiences.

Partner with Latin American tour operators to build niche itineraries (e.g., Scandinavian nature tours, Northern Lights, wellness).

Offer travel packages that appeal to premium and experience-driven segments, including multi-destination tours.

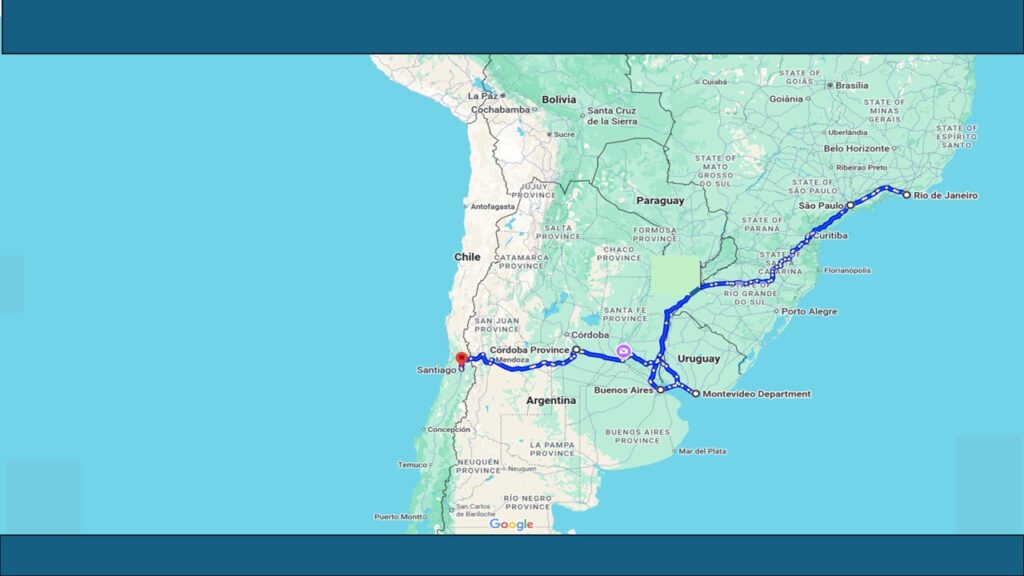

ToolBox Consulting Roadshow combining Argentina, Brazil, Chile and Uruguay, 12.4 – 24.4.2026

See more about the event: https://www.toolboxtravel.fi/event/south-america-roadshow-2026/

Sources

GBTA — Business Travel Spending in Latin America, 2025 outlook.

GBTA

ECLAC — Growth Projections for Latin America & the Caribbean.

Cepal

World Bank — Latin America Economic Outlook.

Maailmanpankin Asiakirjat

Statista — Travel & Tourism Market Forecast for South America.

Statista

WTTC / VFS Global — Long-term Opportunity Report for LATAM Travel & Tourism.

TravelDailyNews International

WTTC — Brazil Travel & Tourism Sector Forecast.

Hotel News Resource

TravelDailyNews — Trends in Latin America connectivity & product development.

TravelDailyNews International

GlobeNewsWire — South America Tourism Destination Market Insight Report.

GlobeNewswire

Amadeus / Tourism Analytics — Travel Insights 2024 (Americas).

tourismanalytics.com

ETC — European Tourism Quarterly Report Q2 2025.

ETC Corporate

ETC — European Tourism Trends & Global Travel Service Forecast.

ETC Corporate

ETC — European Tourism Q1 2025 Public Report.

ETC Corporate

Travel & Tour World — Europe Tourism Growth (Nordics, etc.)

Travel and Tour World